Table of Content

Right now, we estimate there are over 200 home loan options available. The team at MoneyHub has handpicked what we consider the best mortgage deals available right now. Our list of home loan offers applies to first-time and existing homeowners looking to refinance or buy a new home. You have one account to manage your mortgage payments, expenditure and your income. As your pay goes in each week, fortnight or month it acts like one big mortgage payment.

You’ve also got to remember you can also negotiate your interest rate with a bank . Buying a property is usually the most expensive purchase a person will make in their life. Making the home loan journey easy for you anytime, anywhere.

Want some help to get a home loan?

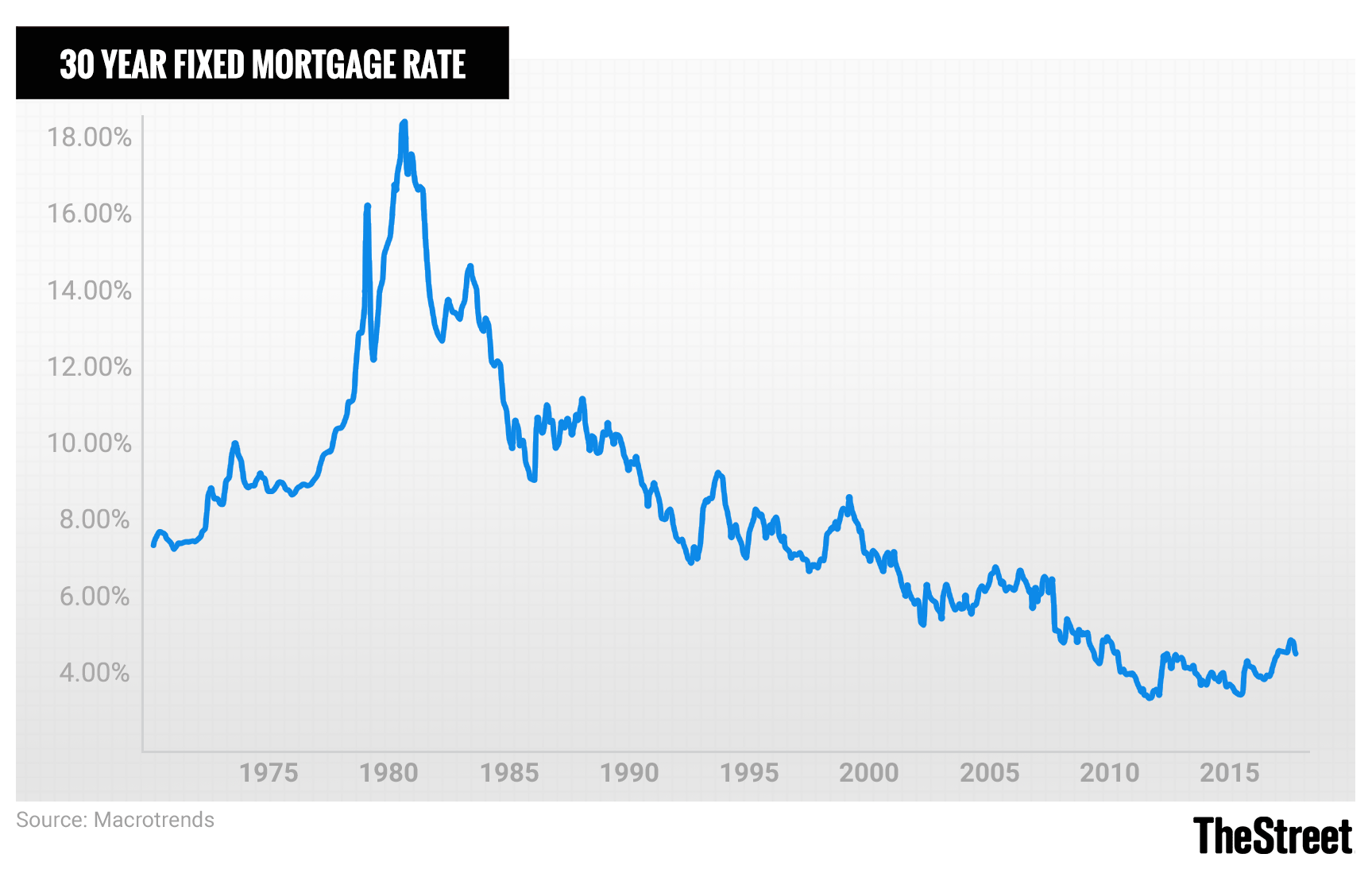

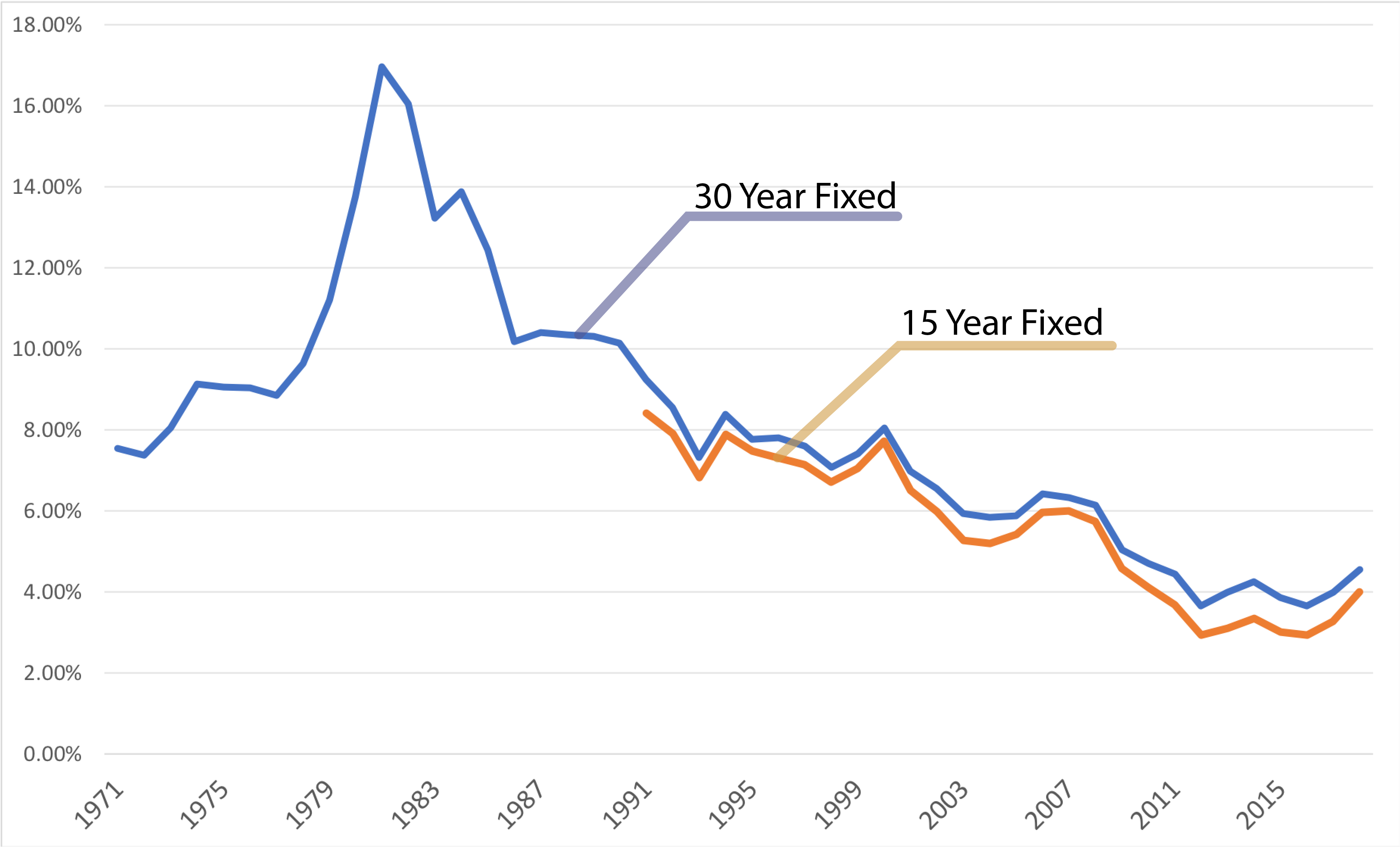

Interest rates are on the rise, so best to lock in a rate sooner than later. See our range of handy home loan calculators to help you decide your best next move.

These days most mortgages allow extra repayments, although some fixed-rate mortgages do not. Most borrowers in New Zealand opt for principal and interest mortgages because as you repay the loan, you gradually build home equity and own more of your property. Equity, if you’re unaware of the term, refers to the value of your home minus any debt you owe on it.

When Will Interest Rates Go Down?

We’re here to provide a single source of mortgage information, to make online research easier. And because we’re completely independent, we tell it like it is – without a sales pitch. By reading our helpful guides, mortgage insights and latest news, you’ll get an all-round education that supports better home finance decision making.

When you choose to use our Refinancing Package, you will be using Kiwibank’s legal transfer service instead of using your own solicitor. When you ask us for new lending on a new loan or an existing home loan, or you are increasing an existing loan. When we demand payment of all amounts outstanding under your home loan because you are in default. Thousands of Kiwis have trusted us with their decisions.

What type of borrower are you?

Be wary of early repayment fees, and if you repay a fixed rate mortgage early you might have to pay a cost. There are many types of mortgages, with different interest rates, fees and flexibility which can affect the repayment amount and the mortgage term. The different mortgage types include fixed interest rate mortgages, floating rate mortgages, table loans, revolving credit loans, offset loans, reducing loans and interest-only mortgages. This means you can split your home loan between both options, taking advantage of certainty and exposing you to the risk of interest rate changes. Look no further, as glimp’s mortgage calculator will help show you what your monthly repayments will be and it will help you find the best mortgage rate from a variety of providers. Simply enter the amount you want to borrow, your preferred loan period and the period for which you’ll be paying a fixed mortgage rate for and we’ll show you your best options.

Find the best mortgage rates and compare mortgage providers now. And one of the best places to start your hunt for the lowest mortgage rate is Canstar’s home loan database, ratings and awards. However, there remains a wide disparity between the lowest rate on our tables, 5.75% (2-year fixed), and the highest, 8.09% (1-year fixed rate). So for canny consumers who are prepared to do their homework and search out the lowest mortgage rates, there are still savings to be made. Canstar may earn a fee for referrals from its website tables, and from sponsorship of certain products. Fees payable by product providers for referrals and sponsorship may vary between providers, website position, and revenue model.

Interest rates & fees

If you do not meet the above criteria, you may still be able to use our Refinancing Package to refinance to Kiwibank, however you will need to pay a Refinancing Package fee. Where we’re changing multiple existing loans, the fee applies per changed loan. When we pay local authority rates that are due on security provided for your home loan.

He has written for Money Magazine, Homely, and for multiple banks and lenders. Richard trained as a high school teacher but found it easier to manage personal finances than a classroom full of kids. Before joining Finder, he edited textbooks and taught English in South Korea.

If you fix for the one-year rate, then you’ll pay a lower interest rate. In 2020 the one year mortgage interest rate was around 2.5%, and the 5-year was 2.99%. Mortgage adviser, Peter Norris says the question of whether to fix for 3 or 5 years really comes down to how high you think the market is going to send interest rates. The current 3-5 year interest rates could look expensive in the next few years. To do this, many Kiwis will use a revolving credit or offset facility.

With fees for owner-occupier mortgages generally consistent between lenders, the interest rate is the best measure of whether or not it’s a good deal. For example, a 3.99% interest rate mortgage with a $500 application or establishment fee is better than a 4.49% interest rate mortgage. In addition, it’s a good idea to consider how much rental income you receive for the property when deciding how much you can afford in mortgage repayments. If the rent doesn’t cover the mortgage repayment, an interest-only mortgage could help to keep your monthly costs affordable.

Their experience is unrivalled, and they will happily answer your questions about all things concerning the process of owning a home. Once you have the deposit together, you need to apply for a home loan with a lender. As part of the application process, you will need to show your earnings, expenditures, savings and how much you’d like to borrow. Here’s what happened in 2022 for mortgage interest rates. If you are changing lenders and your deposit is not currently held with the lender you will need to prove that you have the deposit. You can do this via bank statements covering the last 6 months.